Biography

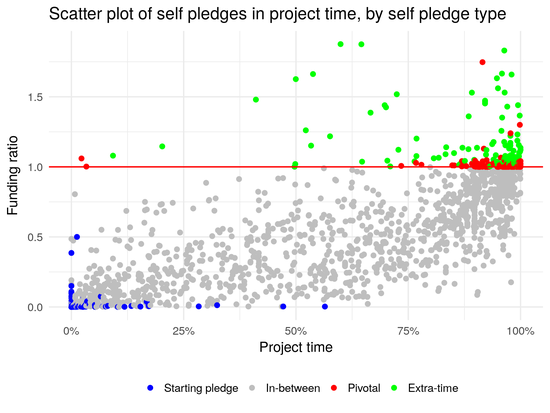

I am a social scientist working with data. My core research interest is pro-social behavior. I study its underlying motivations (e.g. reciprocity, moral emotions, self-, and social-image concerns) as well as its potential for improving market allocations. Crowdfunding, a recently emerged alternative funding channel for entrepreneurial activities, is a particular focus of mine. For my analysis I employ laboratory or field experiments as well as big data sets from online sources.

Interests

- Behavioral economics

- Experimental economics

- Crowdfunding and e-commerce

- Machine Learning

Education

PhD in Economics, 2004

University of Bristol, UK

Diploma in Economics, 2000

University of Munich, Germany